What is Money Laundering? Vast amounts of cash are cleaned globally on a daily basis. Nevertheless, the Wachovia bank incident stands out as the most notable instance of money laundering in history. A staggering $380 billion was cleansed through this major US bank before its acquisition by Wells Fargo in 2008 amidst the financial crisis.

What is Money Laundering?

Before delving into this guide, you may have wondered: What is Money Laundering, and why is it deemed illegal? This guide will provide you with an in-depth understanding of money laundering.

Money laundering refers to the method used by criminals to conceal the illicit origin of their profits, typically generated through unlawful business activities. Essentially, money laundering is a way for these individuals to transform their ill-gotten gains into ‘clean’ or ‘legal’ money that can be documented in government records and utilized universally.

Every year, criminals worldwide launder trillions of dollars, casting a dark shadow on the future generations and undermining the economies of their respective countries.

It may come as a surprise, but some financial institutions are implicated in these clandestine activities, facilitating money laundering operations.

Combating money laundering has grown to be a paramount concern for numerous countries globally, with the scope now broadened to include thwarting funding for terrorist activities.

Why is Money Laundering illegal?

We often come across a myriad of money laundering cases in federal court, each tied to some form of financial crime. These crimes range from drug offenses and cybercrimes to fraud, embezzlement, or even crimes related to the Racketeer Influenced and Corrupt Organizations (RICO) Act.

Money laundering is unambiguously illegal, serving as a significant financial crime perpetrated by both street-level and white-collar criminals. In contrast, Anti-Money Laundering (AML) comprises a series of policies and procedures designed to monitor and prevent such illegal activities.

The proceeds obtained through money laundering are categorically illicit as they originate from ‘tainted’ and ‘unscrupulous’ sources, fostering poverty and corruption.

One of the most alarming aspects of the laundering process is the criminals’ ability to make the ill-acquired money appear as legitimately earned income.

Moreover, the substantial surge in cryptocurrency investments and digital banking transactions has offered criminals an accelerated path to seize the hard-earned money of unsuspecting individuals.

Why People Launder Money?

Businesses that handle large amounts of cash often face the significant challenge of concealing their money from government scrutiny. Those who benefit from such sizable income want to present their earnings as originating from legitimate sources to avoid incurring substantial tax obligations. Apart from businessmen, various criminals engaged in unethical or deceptive practices aid these entrepreneurs in laundering money and prevent legal authorities from probing the matter.

Such criminals or fraudsters also launder money on their own behalf, engaging in activities such as drug trafficking, human trafficking, or perpetrating fraud involving commodities, mortgages, financial institutions, and banks, all in the pursuit of earning large sums of money in a short period.

Once they manage to realize their illicit business schemes and accumulate a substantial amount of cash, they are faced with the issue of handling millions and the need to ‘launder’ this money to obscure its illegitimate origins.

Money Laundering Variants

Those involved in money laundering often disassemble large sums of money into smaller amounts and distribute them across various bank accounts held by different individuals to evade detection. This method is referred to as smurfing or structuring.

Alternatively, money laundering can also be accomplished via wire transfers, foreign exchange transactions, and the use of cash couriers, often known as ‘mules.’ Mules’ primary function is to covertly transport large sums of cash across international borders and deposit them into overseas accounts to minimize risk. But how is this achieved? Mules utilize bank accounts of individuals in a country where enforcement against money laundering is relatively lax.

Another method of money laundering involves investing ill-gotten funds in various commodities like gold or other precious stones that can be effortlessly transported across different locales, cities, states, or countries.

Criminals can also launder money through the sale of valuable assets like real estate or through gambling. They may also employ shell companies – entities that only exist on paper and lack a physical presence.

How Do You Launder Money?

Money laundering holds appeal for those affiliated with criminal syndicates and for individuals with a criminal mindset. The laundered money can be utilized for whatever objectives these criminals might have.

There are numerous methods to launder money, with one of the most prevalent techniques being the use of a legitimate cash-based business, owned by the criminals themselves, to transform illicit gains into ‘clean’ money. For example, a criminal might establish a restaurant as a facade to conceal their unlawful income source, using the restaurant’s bank account to deposit and later withdraw funds as necessary. Such businesses established by criminals are commonly referred to as ‘Fronts.’

Furthermore, digital banking has given a new lease of life to this age-old crime. The surge in peer-to-peer transactions and anonymous digital payments via mobile phones have provided cybercriminals with an easy route to siphon public funds into their own accounts through immoral means. The detection of illicit money transfers has become increasingly challenging due to the rising use of proxy servers and anonymizing software – the money transferred and withdrawn leaves no IP address trace, making it particularly difficult to detect.

Moreover, a significant amount of money is laundered via online gaming sites, gambling platforms, online auctions & sales, and cryptocurrency exchanges. The latest frontier in money laundering includes Bitcoin laundering, owing to its relative anonymity compared to traditional money, making it highly favored for drug trades, extortion schemes, and other illegal activities.

What are the 3 steps in money laundering?

Handling large sums of cash can be perilous, precarious, and inefficient. Nonetheless, criminals must find a way to deposit these substantial amounts into bank accounts, making it seem as though the money has originated from a lawful source.

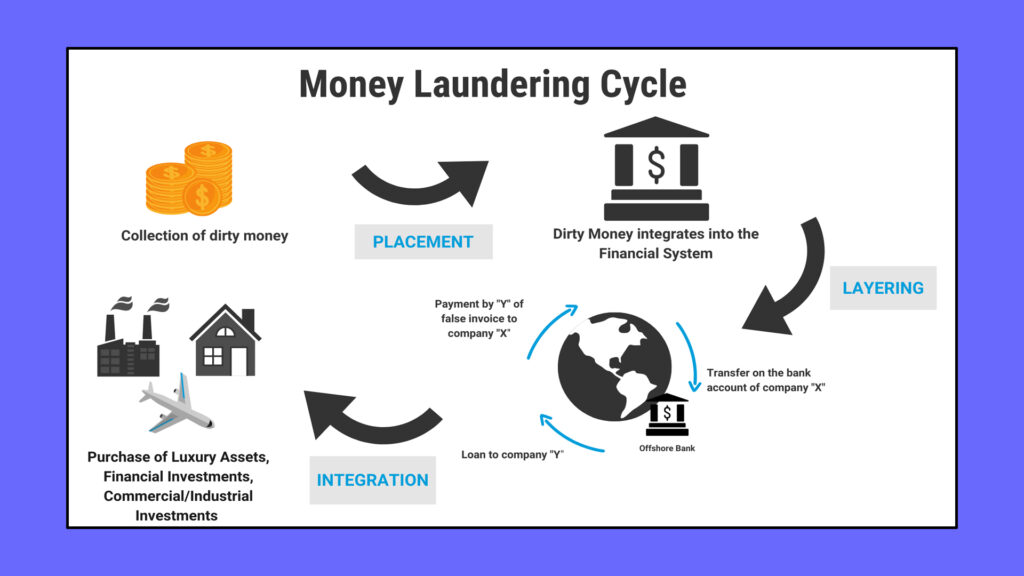

The steps in the money laundering process usually involve three phases:

1. Placement or Initial Entry

This is the first phase where money acquired through unlawful means or any criminal activity is introduced into a legitimate financial system or institution. These illicit methods of obtaining funds can encompass activities like bribery, theft, smuggling, and corruption.

The amount of cash can be divided into smaller sums or converted into financial instruments such as money orders, drafts, checks, and then deposited directly into offshore accounts.

This is the preliminary stage where the ill-gotten money is ‘laundered’ and masked within a legitimate financial structure.

2. Layering

Following the successful deposit of funds into bank accounts, the second stage, known as layering, occurs. This step involves moving the money through various investments, transactions, or businesses that assist in obfuscating the money’s original source. The layering stage primarily aims to muddy the audit trail by cleverly manipulating financial transactions and accounting techniques.

3. Integration Stage

The ‘dirty’ money is then reintroduced into the economy as the funds are integrated back into the legal financial framework. This stage is particularly critical and must be executed carefully to fabricate a plausible explanation for the source of the funds.

Differentiating between legal and illicit money at the Integration stage can be challenging. At this point, the criminal can freely access and use the money without further need for concealment. If there are no records from the earlier stages to serve as evidence, catching the criminal becomes increasingly difficult.

Examples of Money Laundering

The procedure of money laundering is significantly intricate. It presents a daunting challenge for a criminal to inject their illicit funds into the financial system or the nation’s economy. If they succeed in doing so, they expose themselves to a myriad of risks and must involve several individuals to execute a flawless organized financial crime.

I) The Achievement of the Placement Stage

The following examples and methods will provide you with a deeper understanding of the stages of money laundering.

The most frequent examples of the first stage of money laundering, the placement stage, are listed below:

1. Blending Illicit Funds

In this scenario, a business mixes its illicit funds with legitimate earnings. This blending of funds is typically accomplished through cash businesses like restaurants/hotels, salons, car washes, casinos, strip clubs, bars/clubs, etc. These businesses have minimal or non-existent variable costs, making them an ideal choice for launderers seeking to merge illegal funds into the financial system.

2. Smurfing

“Smurfs” are individuals who dodge oversight from banking authorities by breaking up large amounts of money into smaller portions that are below the reporting threshold. The illicitly acquired funds are typically deposited into several individual bank accounts or by a single person over an extended period.

3. Invoice Fraud

This is a basic technique used by criminals involved in money laundering. They ‘wash’ their illegal money using over-invoicing or under-invoicing, phantom shipping (where no actual item is shipped, but a fabricated invoice is generated to justify an incoming payment), and false descriptions of goods/services.

4. Aborted Transactions

Money is transferred to a lawyer for an extended period until a proposed transaction is completed. If necessary, the transaction is aborted, and the funds are returned to the criminal from a secure source.

5. Overseas Accounts

Money laundering often involves depositing funds into offshore accounts (accounts located outside the criminal’s home country). This helps criminals evade taxes and conceal the identity of the actual beneficiary.

6. Transporting Small Sums Across Borders

Laundered money can be moved from one country to another covertly and under the custom declaration threshold. The easiest way to do this is to break up a large sum into smaller cash amounts. Once the cash reaches the foreign country, it is deposited into local bank accounts.

II) Achieving the Layering Stage

Layering, the most complex stage, can be accomplished using the following strategies:

- Investing money in financial institutions such as the stock market.

- Converting funds by investing in shell companies with functional fronts or into real estate.

- Electronically transferring money across borders using legislative loopholes. The layering stage revolves around ‘washing’ your ‘dirty’ money and converting it into clean funds.

III. Achieving the Integration Stage

The illicit money can be integrated into the national economy through:

- Fake invoices with overvaluation of goods being exported or imported into a country.

- Investment into real estate, luxury vehicles, artwork, gold, or other high-priced commodities.

Money Laundering Act

The Act for the Prevention of Money-laundering came into existence in 2002. The main rationale behind its establishment was to curb the funneling of money into economic crimes and unlawful activities. However, it was not until July 2005 that the act and its associated rules were activated.

The NDA government implemented the money laundering act with the intention of confiscating property implicated in, or originating from, money laundering, thus deterring other fiscal crimes.

Banks Involvement In Money Laundering

As previously mentioned, some financial institutions, including banks, have been implicated in money laundering activities. A number of banks have been found guilty of aiding criminals by permitting them to deposit substantial amounts of money without reporting these deposits to the relevant government bodies.

Two such instances involve HSBC and Danske Bank, which were both found guilty of failing to report large cash deposits to the central bank authorities or government regulatory agencies. Back in 2012, HSBC was charged with laundering $1 billion. Concurrently, Danske Bank was discovered to have facilitated the laundering of over $200 billion for the Russian mob over a period of 8 years (2007-2015).

Disguising ‘Dirty’ Money through Investments

Illicitly earned cash can be effectively concealed and integrated into the formal financial network through a variety of clever tactics employed by criminals. One of the most fundamental and frequently employed strategies involves leveraging a foreign investor to transform tainted money into clean assets.

Consider the following scenario: a criminal syndicate needs to clean a substantial amount of cash, amounting to billions of rupees. They then engage a foreign investor to assist in masking the source of this money. Once the cash is transferred to the foreign investor, it is then reinvested into a lawful domestic enterprise controlled by the criminal organization, typically a shell corporation.

Criminals are careful to maintain a separation from the foreign investor, avoiding any visible connections. They can then access the money within the shell company by having it invested into other criminal enterprises or loaned to other companies.

Subsequently, the shell companies may report losses — for instance, by defaulting on a loan. These declared losses can significantly reduce the tax liabilities. Such a loan default might even lead to the dissolution of the shell company through bankruptcy.

Once the shell company is gone, the criminal can enjoy the funds received from the so-called ‘foreign investor’, a now legitimate-looking source. Thus, criminals manage to clean their illicit cash with the assistance of two entities that no longer exist, making tracing the money back to its original source an arduous task for investigators.

A word of caution: While it may seem like you now understand how money laundering works, remember that its practice is highly illegal and dangerous. If caught, severe penalties await the guilty party.

What is Anti-Money Laundering?

Anti-Money Laundering (AML) refers to the set of procedures, laws, and regulations that financial institutions employ to prevent financial crimes. Essentially, AML acts as a safeguard to prevent criminals from masking illicitly acquired funds as legitimate earnings.

All companies are required to comply with AML standards and policies. However, achieving AML compliance can be a complicated process for businesses, leading many to establish dedicated departments solely for this purpose.

The recognition of AML initiatives started to grow when a collection of nations established the Financial Action Task Force (FATF) in Paris in 1989. The FATF pioneered anti-money laundering measures and ensured their application. Moreover, it created global standards for the prevention of money laundering.

Process of Anti-Money Laundering

Every business is mandated to adhere to certain rules and regulations aimed at curbing money laundering. A fundamental practice for all companies is the implementation of the ‘KYC’ (Know Your Customer) process. This enables businesses to gain detailed knowledge about their customers and helps in determining if a transaction could potentially be suspicious.

To gain deeper insights about their customers, companies can also implement Customer Due Diligence procedures. These procedures empower them to identify customer-specific risks and adopt necessary steps to mitigate them. Certain customers, such as politically exposed persons (PEPs), are categorized as high-risk.

In addition to understanding your customers and assessing their risk profile, regularly reviewing their transactions is also critical. Constant monitoring enables organizations to identify suspicious transactions swiftly and generate immediate alerts.

Why is Anti-Money Laundering Significant?

Keeping pace with evolving Anti-Money Laundering (AML) regulations can pose a significant challenge for companies, especially as these rules are subject to frequent updates.

The current climate has seen a substantial increase in audits and penalties, underscoring the critical importance of AML compliance for all entities.

For this reason, it becomes essential for every organization to assign an AML compliance officer to strictly adhere to these procedures and regulatory requirements. This role is key in preventing financial crimes. However, it’s unfeasible to manually cross-reference the multitude of sanctions and watchlists that exist globally. No company wants to inadvertently do business with a client who features on these lists. Which is why a compliance officer’s role is crucial in verifying a customer’s status.

In light of this, tools like the Sanction Scanner are increasingly becoming popular. They simplify the process of screening for sanctions. Making it easier for compliance officers worldwide to verify their customers’ standing in these registers.

AML Compliance Software

As technology progresses, the nature of criminal acts continues to evolve. Leading Anti-Money Laundering (AML) compliance software, such as the Sanction Scanner. Has made complex compliance procedures easier for businesses to manage, shielding many from the impact of financial crimes. Despite having its own set of strengths and weaknesses. It’s indisputable that technology serves as a key instrument in combating financial crimes.

Here are the AML solutions provided by the Sanction Scanner to help stave off financial crimes:

- AML Transaction Monitoring Software

- AML Name Screening Software

- Adverse Media Screening Software

- Transaction Screening SoftwareHow much Money is Laundered Every Year?

Tracking money laundering is an intricate task, however, rough estimates provide an idea about the extent of this global issue.

A study carried out by the United Nations Office on Drugs and Crime (UNODC) aimed to quantify the illicit profits generated by organized crimes and drug trafficking. The research found that approximately $2 trillion was laundered globally due to these activities, amounting to over 4% of the world’s Gross Domestic Product (GDP).

How does Money Laundering Affect Other Businesses?

The financial systems of banks and other institutions are often seen as operating under stringent professional, legal, and ethical standards. However, if these respected institutions engage in criminal financial activities. Aiding fraudsters in stealing or laundering public funds, it signifies that they have become part of the criminal network themselves. Unearthing evidence of such connections can have devastating implications for government regulatory authorities. The perceptions of other financial marketplaces, and their customers.

The escalating impacts of money laundering can lead to adverse macroeconomic consequences, influencing crime, corruption, and undermining societal integrity. It could also trigger unexplained shifts in the demand for money, increased volatility in international capital flows, risks to banking stability. A surge in exchange rates due to the overseas transfer of assets, and harmful effects on lawful bank transactions.

Does Money Laundering Impact Economic Development?

The methods to secure laundered money continue to evolve, with criminals persistently seeking innovative ways to clean their illicit earnings. Moreover, growing financial centers within economies are more susceptible as their established counterparts are renowned for implementing thorough anti-money laundering strategies.

Frequently, those engaged in money laundering shift their operations to countries that are easily exploited. Featuring weak financial security systems or insufficient counteractive measures. This movement can adversely impact foreign direct investment when a nation’s economic. And financial sectors fall under the sway of organized crime. Thus, establishing a robust market environment is crucial to foster economic development and ensure sustainable growth.

Who Should I Contact If I Perceive any Money Laundering Case?

FATF functions as a decision-making entity and does not possess the authority to conduct any investigations concerning money laundering. If you ever find yourself in a scenario where you suspect someone of engaging in money laundering activities. It’s advisable to reach out to your local investigative agencies promptly.

Contacting Fraud Barristers

In the event that you find yourself inadvertently or deliberately entangled in activities related to money laundering. The crucial step to take is to consult with an experienced lawyer. This advice will help you to avoid potential penalties or future charges.

If you or someone you know happens to get involved in money laundering. Don’t hesitate to reach out to a barrister specializing in fraud cases. Such legal experts are equipped with the skills necessary to help you navigate through challenging circumstances.

Now that we’ve provided a comprehensive explanation on the concept of what is money laundering. Feel free to share your thoughts or experiences in the comment section below. Perhaps you’re curious about this topic for a particular reason. Maybe you’ve encountered a situation involving laundered money – we’d love to hear about it!

If you have any questions after reading our article, please leave them in the designated section below.

Stay tuned for our next blog post on ‘how to report money laundering’. It could be useful if you ever come across such a scenario!