Understanding various financial transactions doesn’t necessitate a career in banking. Though we regularly partake in numerous transactions, many of us remain unaware of a wide range of others. Here are some different types of banking transactions you ought to be familiar with.

With the growth of a nation’s economy comes the increase in the quantity and diversity of transactions. Given this expansion, using physical cash for every transaction isn’t logistically viable or convenient. Furthermore, when it comes to handling substantial sums of money, issues around safety and transport of cash arise. To resolve these issues, banks and other financial institutions provide an assortment of payment systems.

Understanding Payment Systems:

A payment system is a structure that enables the execution of financial transactions by way of monetary value transfer. It supports the reciprocal flow of payments in exchange for goods and services within an economy.

In the past, cash was the sole payment medium consumers employed for their everyday purchases of goods and services. However, banking institutions now provide alternative payment tools across various platforms and channels, simplifying transactions significantly.

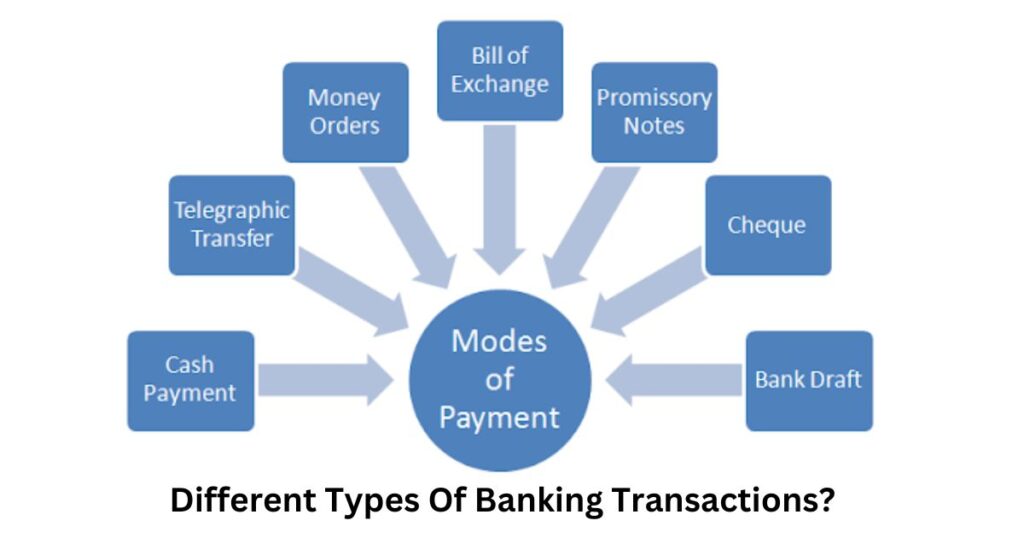

A Look at Various Different Types Of Banking Transactions

To simplify matters, we’ve categorized the different types of banking transactions as follows:

NEFT (National Electronic Fund Transfer)

NEFT is a popular method for transferring money from one bank to another. To conduct an NEFT transaction, all you need are two pieces of information:

- Account Number

- IFSC Code There is no upper limit on the amount you can transfer, but individual banks may impose their restrictions.

RTGS (Real Time Gross Settlement)

RTGS operates similarly to NEFT, but the way the amount is credited and the minimum transaction limit vary. This service should be used for transferring amounts exceeding 2 lakhs. No maximum limit applies, and transactions typically complete in 30 minutes.

IMPS (Immediate Payment Service)

Known as IMPS, this instant fund transfer service operates 24/7. It’s essentially a blend of NEFT and RTGS. To safeguard against fraud, there is a relatively low minimum transaction limit. To conduct an IMPS transaction, all you need is the receiver’s IMPS ID (MMID) and phone number.

UPI (Unified Payments Interface)

The Unified Payments Interface, or UPI, is a real-time payment system that enables transactions via a Virtual Payment Address (VPA). Transferring funds does not require any account details – all you need is a mobile number or UPI ID. You can conduct UPI transactions 24/7, but the maximum limit is Rs. 1 lakh.

Digital Payments:

Banking Cards

Banking cards, featuring various benefits such as secure payments and convenience. Are one of the most used payment methods. They facilitate various types of digital payments and can be used with PoS machines. Card information can be stored in a digital wallet for cashless payments. Notable card payment systems include VISA, MasterCard, and Rupay.

AEPS (Aadhaar Enabled Payment System)

AEPS supports all banking transactions, including cash withdrawals, payment transactions, Aadhaar to Aadhar fund transfers, and balance inquiries. Transactions are carried out using Aadhaar verification, so there is no need to physically visit a branch, provide card details, or sign any documents. This system is operational if your Aadhaar number is registered with your bank.

PoS Terminals

Commonly known as credit/debit card readers, PoS terminals are handheld devices found in physical stores. There are various types, such as Physical PoS, Mobile PoS, and Virtual PoS. Mobile PoS terminals function via a tablet or smartphone, beneficial for small businesses. Virtual PoS systems use web-based applications for payment processing.

Paper-based Payments:

Cheques

Cheques allow individuals to transfer money from one account to another. You need to issue a cheque, naming yourself as the payee, along with the account number to which you’re transferring funds and your signature. If the recipient’s bank is the same as yours, the transfer completes within one day. There is no set transfer limit. But withdrawals exceeding Rs.50,000 from a non-home branch are not allowed.

Demand Drafts

A demand draft is useful when a person wants to send money to another person in a different town or city. The sender can deposit cash or issue a cheque to the bank, which will then issue a demand draft. The recipient deposits the demand draft into their account to receive the payment. Banks usually charge a commission for this service.

Banker’s Cheque or Payment Order

Banker’s Cheques or Payment Orders operate similarly to demand drafts and are used for sending and receiving payments within the same city. They have a short validity period, and banks may charge a commission for issuing them.

Hopefully, this provides ample information about the different types of banking transactions. If you have further queries, feel free to post them in the comment section.

Read More Articles : Top Best Government Business Loan Schemes For MSMES and Startup