Guide to Cryptocurrency! The term can be somewhat puzzling, right? Nevertheless, it’s currently the topic of conversation for almost everyone. If you’re eager to learn about this virtual digital currency, you’ve come to the right place. On this platform, we’re here to educate you about a hot, trending topic straight from the market!

This article serves as an all-encompassing guide to beginner’s guide to cryptocurrency I promise, the learning journey will be enjoyable. Before we delve into the core topic, it’s crucial to have a solid understanding of what cryptocurrencies are, their history, advantages, the process of buying them, and numerous other key points associated with them.

A Beginner’s Guide to Cryptocurrency

What Exactly is Cryptocurrency?

Cryptocurrency is a virtual or digital currency that uses cryptography to control the creation of new units and secure transactions. Cryptocurrencies are decentralized, meaning they are not backed by any government or financial institution worldwide.

Cryptocurrency came into existence in 2008. Unlike traditional fiat currencies, which are issued by governments and banks, cryptocurrencies operate independently of these central authorities, using a digital ledger known as blockchain technology.

Cryptocurrencies have grown incredibly popular recently. These virtual coins are created through a process known as mining. It’s important to know about the prominent platforms for buying and selling cryptocurrencies. How can one invest in them? What are the risks involved? How do prices fluctuate?

This article is a comprehensive beginner’s guide to cryptocurrency, designed to educate you about everything you need to know about these valuable altcoins. This guide will impart complete knowledge about Cryptocurrencies, helping you understand their significance in today’s world. Furthermore, you’ll learn how to buy, sell, and trade cryptocurrencies and how to safeguard your investment from risks. Don’t let this opportunity pass! It’s time for you to navigate the crypto marketplace.

Evolution of Cryptocurrency: Who created it and how it came?

Its Creator and Origins The identity of who created cryptocurrency remains a mystery. It’s been akin to finding a needle in a haystack, but it appears the search might be nearing its conclusion. Experts suggest that an individual or a group named Satoshi Nakamoto is the mastermind behind this groundbreaking digital currency.

Satoshi began developing the revolutionary code that would eventually lay the foundation in 2007. In 2008, he published a whitepaper for this cryptocurrency and its original software reference implementation (the program establishing all technical standards). Today, there are over 10,000 cryptocurrencies in the market, including Bitcoin, Ethereum, Co-trader, Stellar, Litecoin, and many more.

Bitcoin stands out as the most valued and largest cryptocurrency. CoinMarketCap reports Bitcoin’s market capitalization to be close to $900 billion, followed by Ethereum, with less than $500 billion.

Cryptocurrencies aren’t just some wild inflationary currency like dollars or euros; these virtual coins are stored on digital ledgers known as ‘wallets’, accessible via an encrypted PIN (or private key) generated specifically during online registration from your wallet provider.

Throughout the 19th and 20th centuries, many countries used gold and silver as standard currency. This currency standard based on precious metals became more common during times of financial crises caused by wars. However, from the 1920s to the 1970s, most nations abandoned this standard for a variety of reasons, including the inability to produce enough goods to meet economic demands while funding two world wars.

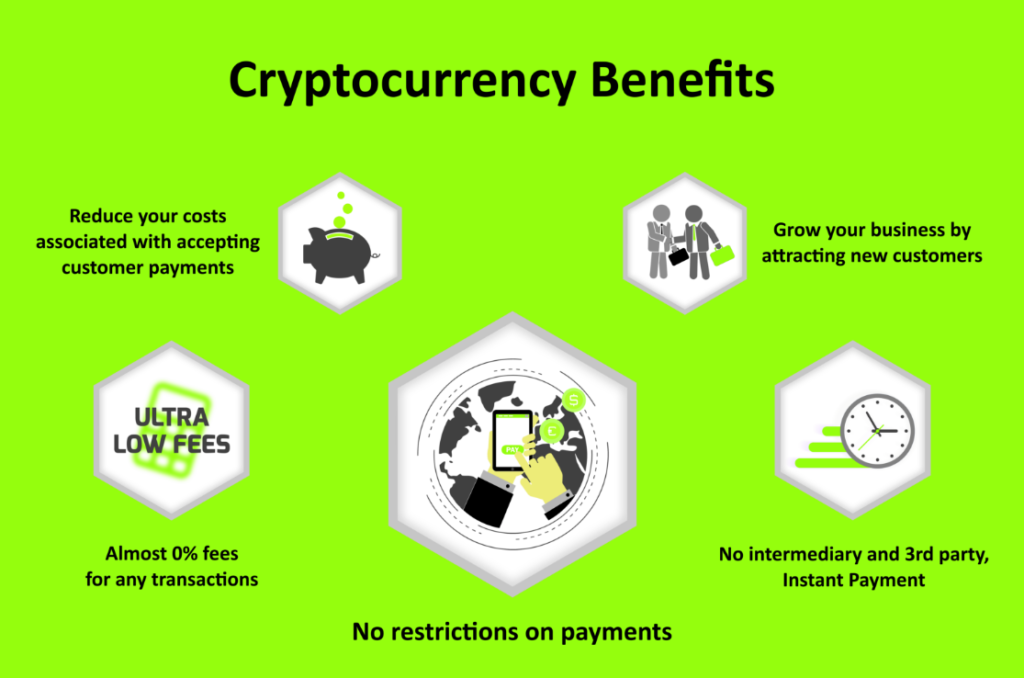

Benefits of cryptocurrencies

Here are several significant advantages of cryptocurrencies in the current market landscape

Security: Transactions are secured by cryptography, making them hard to hack. Anonymity: Transactions can be conducted anonymously, which appeals to some users. Decentralization: Since cryptocurrencies are not under the jurisdiction of any government or financial entity, they are impervious to censorship and manipulation. Digital assets represent one of the most revolutionary inventions in recent times. Based on an electronic cash system, it allows money transfers over computer networks without the need for banks or other third parties.

This groundbreaking invention has sparked interest both nationally and internationally.

How to get started with cryptocurrency?

Cryptocurrencies have gained popularity and have made many people wealthy. As a result, many individuals are looking to invest in them. You could employ a broker or agent to assist you in investing in crypto via a trustworthy crypto exchange. Alternatively, you could read informative articles like this one and start investing in virtual currencies for the long or short term.

All cryptocurrencies are available for purchase. Cryptocurrency exchanges are the avenue to buy crypto assets. These exchanges offer a wide variety of cryptocurrencies and provide users access to an online wallet, akin to banking accounts but backed by personal keys instead of passwords or pins. Isn’t that what you were seeking?

Bitmart, an exchange hacked in July 2018, experienced $150 million worth of cryptocurrency losses.

How to buy cryptocurrency safely?

In this beginner’s guide to cryptocurrency, we walk you through the essential steps required to make secure investments in cryptocurrencies. Here’s a rundown of the four key steps you should adhere to when planning to venture into the world of cryptocurrencies:

1. Determining Where to Buy

Centralized exchanges are the preferred choice for cryptocurrency newbies. These platforms function as intermediaries, facilitating transactions while ensuring the buyers receive their purchases at market rates. This kind of exchange profits from service-related fees, like those associated with withdrawals or deposits.

Investment platforms abound in the crypto universe. Renowned online brokers like Robinhood and Webull present a range of options. But if you’re keen on pure-play exchanges like Coinbase or Gemini that focus on cryptocurrencies, these might be more suitable. Centralized exchanges, despite their popularity for buying, selling, holding, and trading cryptocurrencies, can be susceptible to hacker attacks. Thus, experienced traders seeking cost-effective trades may find decentralized platforms more appealing.

2. Deciding How to Pay

Popular cryptocurrencies like Bitcoin and Ethereum can be bought with conventional currencies like USD, EUR, INR, and many others. Beginners or those unfamiliar with crypto trading could start with regular money. However, seasoned crypto enthusiasts might prefer swapping existing crypto coins for another type of cryptocurrency.

3. Funding Your Account

Depending on the exchange, you can fund your account with fiat money or through secure debit or bank transfers. Caution is required, as the volatile nature of cryptocurrencies could result in significant losses. Additionally, interest costs on losses could inflate your losses if prices plummet.

4. Selecting the Right Cryptocurrency

Before you start trading, thoroughly research the platform and cryptocurrency. Not all coins can be directly exchanged, and some exchanges list more types of coins than others. It is crucial to ensure that the available options match your needs before signing up.

How can you manage cryptocurrency risks?

Cryptocurrency is a high-risk investment, ideally accounting for just 10% of your overall portfolio. Always invest an amount you can get to fail. beginner’s guide to cryptocurrency are advised to consult an experienced financial advisor with cryptocurrency knowledge.

If you have outstanding debts or are saving for retirement, it might be prudent to consolidate these funds before venturing into the volatile cryptocurrency market.

Diversification can help shield your crypto portfolio from value drops. By investing in multiple types of cryptocurrencies and holding them for varying periods, you can mitigate the risk during high market volatility.

Thorough research is key before you invest your hard-earned money in these digital assets. Each digital coin is often linked to a specific technological product in development or rollout. There can be several unknown risks involved, beginner’s guide to cryptocurrency so caution is essential before investing.

Despite the market’s volatility, the future of cryptocurrency seems promising. More consumers are becoming knowledgeable and confident about investing in cryptocurrencies.

How can you keep Crypto safe?

Deciding how to store your crypto is essential. Crypto wallets can help keep your assets safe. Different types of wallets, such as hardware wallets or paper wallets, are available, each with its unique risks, such as loss.

- On-Platform Storage: Many people prefer to keep their cryptocurrencies on the chosen exchange or wallet. This approach provides the advantage of managing private keys without your direct involvement. However, a potential drawback is the risk of security breaches beyond your control.

- Non-Custodial Wallets: Many investors prefer crypto wallets over cold storage. For those who prioritize security and privacy without compromising convenience or accessibility, non-custodial wallet services might be the ideal solution.

Cryptocurrencies are legal in the United States and can offer a secure investment option if transacted through a reliable crypto exchange. However, some countries view these virtual currencies skeptically.

Each nation will eventually form its stance on cryptocurrencies. Regardless, it’s improbable that most will ban them, given the potential for taxation on transactions. For example, Bitcoin, the first cryptocurrency introduced in 2009, has seen varying acceptance worldwide, with El Salvador becoming the first country to officially adopt Bitcoin as of January 1, 2021.

Remember, profits from trading cryptocurrencies are taxable by the IRS. Taxes are based on the investment amount and the withdrawal amount from the crypto wallet. Activities such as mining could also yield valuable coins and are subject to taxation.

Why are cryptocurrencies so popular?

Cryptocurrencies have captured the public’s imagination like no other innovation. They offer a way to transfer digital assets online, bypassing traditional intermediaries such as banks or credit card firms. What’s more, cryptocurrencies facilitate lightning-fast global transfers round the clock. The cherry on top is that all these transactions are performed with anonymity; the fear of government tracking is eliminated as all transactions are encrypted, thus safeguarding users’ personal data from being disclosed.

Top five most popular cryptocurrencies

This novice’s beginner’s guide to cryptocurrency showcases the top five cryptocurrencies that have gained wide acceptance and are considered secure and reliable investment options:

Bitcoin

Bitcoin: The Gold Standard in Cryptocurrency

Arguably the most recognized name in the crypto world, Bitcoin has made waves in the market. It is a cryptocurrency that employs a specific algorithm. Mining, a process that involves resolving mathematical challenges verifiable by other network users, gives birth to Bitcoin.

But it’s not merely about generating new Bitcoins; it also hinges on your craving for them. The system diligently records transactions between Bitcoin accounts globally, reflecting real-time exchange rates with fiat currencies like the US dollar.

The Bitcoin blockchain is a unique digital ledger of the network’s history that is immune to duplication or alteration. Therefore, unlike typical digital data that can be copied and modified freely, Bitcoins are unalterable due to their scarcity, divisibility, and transferability, serving as global currency.

Dogecoin

Dogecoin: From Meme to Mainstream

Much like Bitcoin, Dogecoin is a digital currency. However, it originated as an internet jest aimed at satirizing the Bitcoin craze, drawing inspiration from a popular dog meme. Unlike Bitcoin, created with scarcity as a key attribute, Dogecoin boasts a plethora of coins as developers envisaged them as more than mere tokens for miners.

Ethereum

Ethereum: Cryptocurrency with a Computational Twist

This ethereum isn’t just a cryptocurrency that can be used for financial transactions or as a value store; it also performs calculations during the mining process, ensuring seamless operations on its decentralized network, the ‘Ethereum Blockchain’. Ethereum has caused a stir in the crypto world by facilitating financial transactions, serving as a store of wealth, and even enabling the creation of derivatives trading protocols on its blockchain network.

Litecoin

Litecoin: The Speedy Alternative

A litecoin, designed to outperform Bitcoin in speed and affordability, has produced more than 84 million coins as of March 2022, in stark contrast to Bitcoin’s finite supply of 21 million. This makes it a favorite amongst traders seeking convenient storage for their investments. Furthermore, Litecoin’s founder prioritized transaction speed, designing the coin to deliver on this aspect.

Stellar Lumens

Stellar Lumens: Bridging Boundaries

The cryptocurrency world is a maze of coins and tokens. Yet, until Stellar Lumens, or XLM, there was a gap – a coin that could act as digital currency and facilitate cross-border bank transactions without any charges. XLM is designed to enable low-cost, multi-currency trades like never before. However, Lumens are finite and cannot be mined; the Stellar website specifies a cap of 50 billion Lumens in circulation.

What are Multi-crypto wallets?

Your Gateway to Cryptocurrency Security

As you unravel the world of cryptocurrency, understanding multi-crypto wallets becomes crucial. These wallets are specialized platforms allowing you to store diverse cryptocurrencies in a singular location. They support both public and private keys, which means they can accommodate and manage more than one type of cryptocurrency.

In the volatile universe of cryptocurrencies, a multi-crypto wallet isn’t just another money storage space—it provides access and control, facilitating transactions between individuals on a decentralized network without traditional intermediaries like banks or third-party services.

Navigating the crypto ecosystem requires caution. Avoid unverified wallets that could potentially indulge in fraudulent activities or theft. Always opt for top-rated multi-currency wallets for securing your digital treasures. Such platforms provide a safe haven for your assets, keeping them away from hackers and other digital threats. So, let’s explore the top 5 Multi-crypto wallets as a part of this beginner’s Guide to Cryptocurrency

Exodus

Exodus: The Crypto Beginner’s Best Friend

This offers a blend of elegant design, ease of use, and access to over 100 cryptocurrencies on a single platform, making it an ideal choice for crypto newcomers. Moreover, it’s free! It’s designed with a focus on user security, even offering protection against loss of access to private keys. Its one-click trading feature caters to investors of all expertise levels, facilitating swift investment without the need for extensive technical proficiency.

Exodus ensures user fund security without charging a fee. They channelize every transaction fee via ShapeShift into a separate wallet, adding it to your holdings like any other crypto asset.

Coinomi

Coinomi: A Pioneer in the Crypto Wallet Space

Being in operation since 2014, Coinomi is one of the oldest, most trusted, and innovative crypto wallets with over 2.5 million users globally. It provides native support for more than 1500 cryptocurrencies and 125 blockchains, while ensuring stringent security measures for platform stability.

As crypto mining gains momentum, Coinomi continues to cater to its burgeoning user base, providing informative materials for potential customers exploring the world of cryptocurrencies.

StormGain

StormGain: Simplifying the Crypto Experience

It’s strormGain with its intuitive interface, presents a welcoming platform for beginners venturing into crypto investments. The registration process is smooth, incorporating an acclaimed exchange service offering an incentive system, thereby simplifying the user experience.

Trezor

Trezor: A Fortress of Cryptocurrency Security

In a time where security is paramount, Trezor sets itself apart as one of the most secure wallets globally. This hardware wallet enables transaction signatures without the need for third-party trust. The device generates a unique 24-word passphrase, ensuring secure access.

Trezor enhances security by erasing all data after a two-minute non-access period, safeguarding your funds from theft or compromised software.

Coinbase

Coinbase: Pioneering a Transparent Crypto Future

Born in San Francisco in 2012, Coinbase was created to offer a user-friendly digital wallet for storing Bitcoins. The platform has since expanded globally, maintaining transparency about transaction details and implemented security measures.

Founded by Fred Ehrsam, inspired by Bitcoin’s early-day challenges, Coinbase now facilitates more than $10 billion in monthly trades, boasting 50 million users across the globe. a part of this beginner’s Guide to Cryptocurrency

Binance Wallet:

A Comprehensive Crypto Suite

Binance is not just a cryptocurrency exchange; it’s also a wallet that allows you to store, exchange, or move a wide variety of altcoins. Its stellar reputation adds to its appeal, making it a safe hub for traders who need specific features like ATM withdrawals.

Binance Wallet stands out as a secure and reliable platform with strict verification protocols, ensuring no unauthorized access to users’ accounts. While some may find these extensive security measures daunting, they ultimately serve to protect your digital wealth.

Ledger Nano S:

- Compact Security on Your Palm

Ledger Nano S, a hardware wallet, is capable of running numerous apps without exposing your private keys to the online world. This affordable and malware-proof wallet showcases an OLED display for straightforward Bitcoin or Ethereum transactions.

Reminiscent of a USB flash drive, this wallet stores information offline—ideal in potentially risky environments where internet banking restrictions apply. Created by French company Ledger Inc., it lays significant emphasis on physical and digital protection, guaranteeing the safety of your funds.

Trust Wallet:

- Your Trusted Crypto Guardian

Trust Wallet has cemented its reputation as one of the safest crypto wallets available. Accessible on iOS, Android, and web-based devices, it lets you manage your funds and track prices securely.

A standout feature is its ‘staking’ capability across various coins, enabling users to earn hefty commissions by merely storing them. With easy-to-navigate features like price tracking, Trust Wallet keeps your funds secure from potential threats.

WazirX:

- India’s Crypto Powerhouse

A top choice for Indian crypto traders, WazirX boasts over 8 million users, partly due to its acquisition by Binance. It allows you to safely store hundreds of altcoins and employs 2-factor or OTP-based authentications to further enhance security.

Knowing that your funds cannot be accessed by a third party provides peace of mind. Plus, it ensures that your assets cannot be used without verification via an authenticator app. Offering comprehensive 2FA protection.

Atomic Wallet:

- All-In-One Crypto Hub

Atomic Wallet is a trustworthy wallet that can manage over 300 crypto assets—all in one place. Its unique token, AWC, allows coin exchange and provides discounts, offering a competitively priced solution without compromising convenience or safety.

It even has a marketplace for using these funds to purchase products (excluding credit card purchases). Plus, it rewards those who bring in new customers via its affiliate program.

Crypto diversification has never been easier with multi-currency wallets. Whether you’re dealing in dollars, euros, or any cash currency, these wallets enhance the security of short-term and long-term traders alike.

Pros and Cons of cryptocurrency

While delving into cryptocurrencies, it’s crucial to understand why these virtual assets inspire confidence in some and concern in others. Let’s examine the advantages and drawbacks of beginner’s Guide to Cryptocurrency

Cryptocurrency Pros:

Cryptocurrencies promise to curtail inflation and democratize financial control, attracting considerable interest from investors. Many believe these digital currencies could potentially surpass gold in value, sparking interest in the market before the value soars.

Blockchain, the decentralized processing and recording system backing cryptocurrencies, offers superior security compared to traditional payment systems. Furthermore, crypto staking allows users to grow their holdings without additional investment.

Cryptocurrency Cons:

The experimental nature of many cryptocurrency projects means that long-term investors may not realize expected returns. The prices of cryptocurrencies are known to fluctuate rapidly, resulting in swift gains or losses for investors.

Cryptocurrencies are still largely unregulated, leaving room for potential regulatory changes that could unpredictably impact prices. Furthermore, the unpredictability of coin or token worth can hinder their usage.

The energy-intensive process of mining cryptocurrencies is another concern. Although less demanding algorithms exist for less powerful PCs, the overall energy consumption is significant.

The world of cryptocurrencies can seem overwhelming for beginners. This guide is designed to provide a detailed overview of guide to cryptocurrency. Answer common questions to enhance your understanding of this dynamic digital landscape.

Should you have more queries, don’t hesitate to reach out to us or utilize our recommended resources. Happy trading!

Read More Articles: Bitcoin For Beginners: A Complete Guide